To submit your VAT return you will need to upload a CSV file containing your VAT return data.

You can check here to see if the format of your file is compatible with our services. It is better to do this first than go through the formal process and discover later any issues.

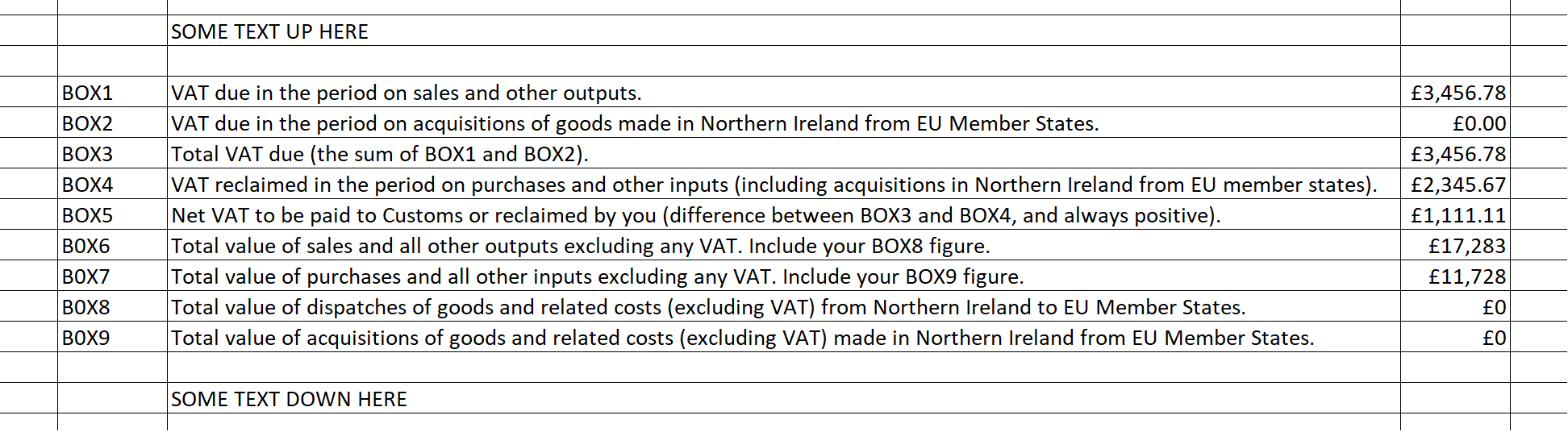

You should create a tab with the data laid out as shown in the image, and then

export that tab to a CSV file.

You can export your VAT data to a CSV file from all major spreadsheet software packages

(Microsoft Excel, Apple Mac Numbers, LibreOffice, OpenOffice).

See our FAQs ➤

for more information on formats we accept and how to create an upload file.

Choose your file below and then click on the 'Check file' button.